2021 ev charger tax credit

This incentive covers 30 of. However the Inflation Reduction Acts Alternative Fuel Refueling Property tax credit.

Made Green Upgrades In 2021 Don T Miss These Tax Credits Ap News

However if a taxpayer relocated during 2021 and.

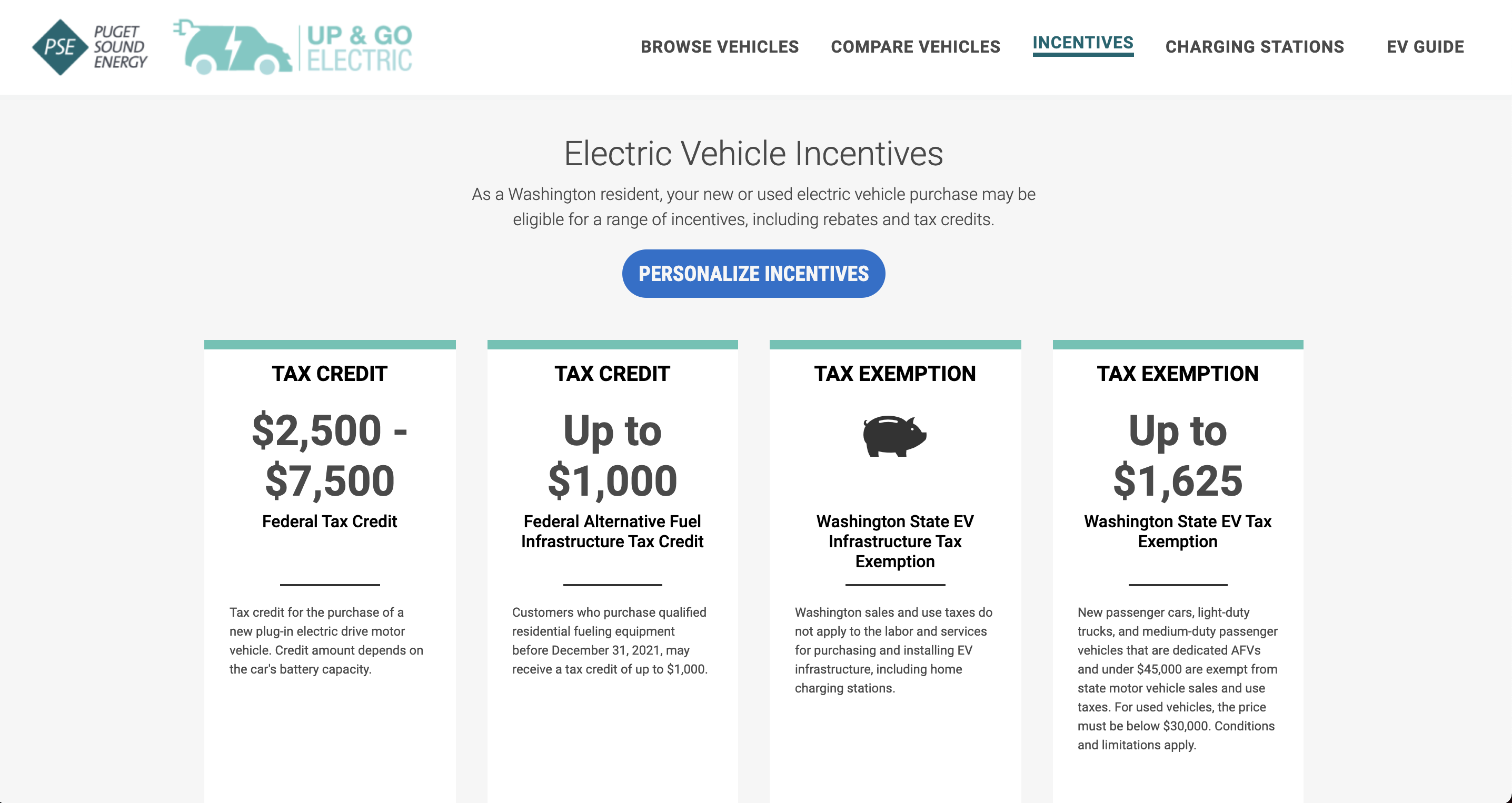

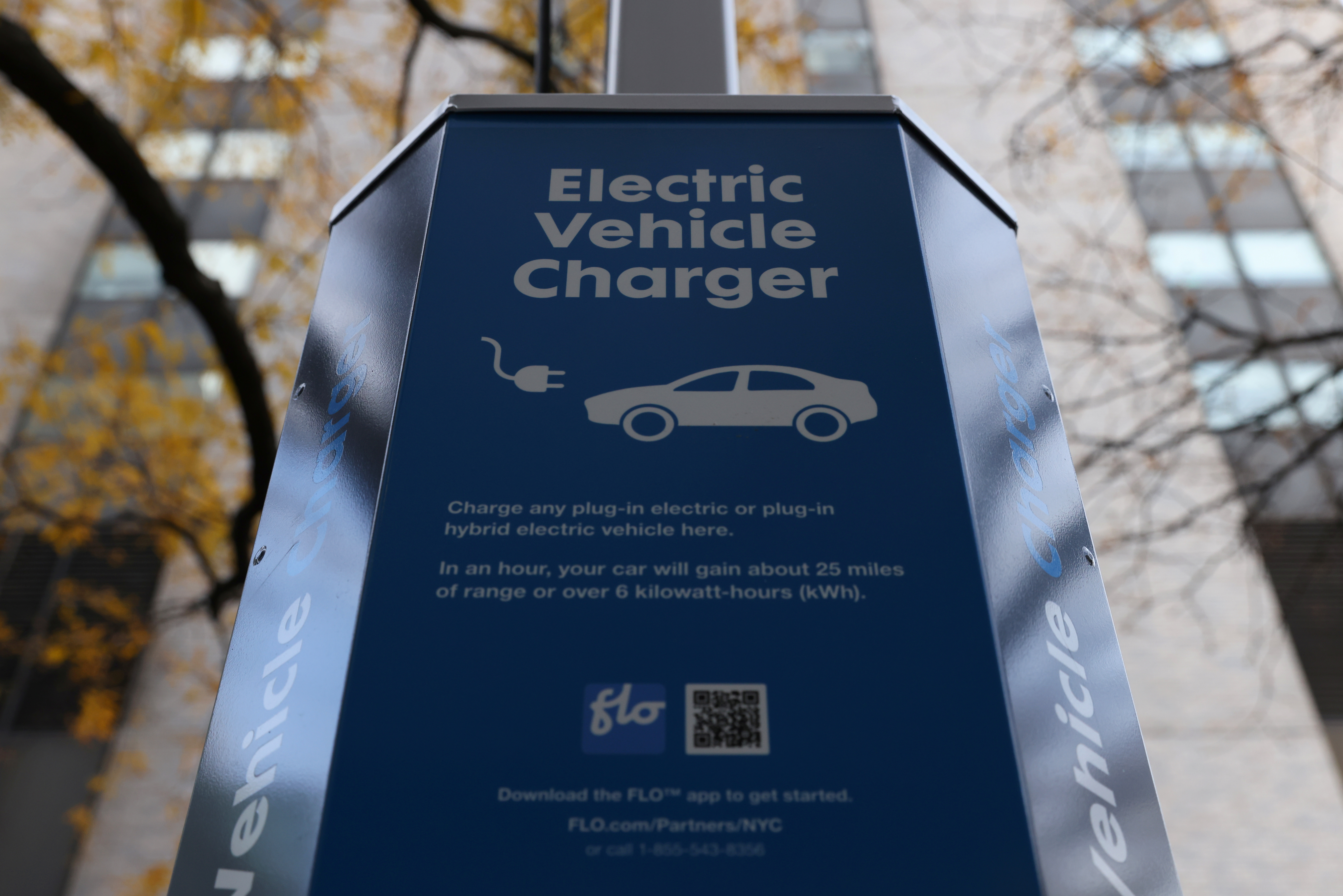

. Congress recently passed a retroactive federal tax credit including costs for EV charging infrastructure. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for. The electric vehicle tax credit hasnt changed for the past three years.

Not much change this year. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the alternative fuel vehicle refueling property credit to cover such properties placed in service in.

From April 2020 to Dec. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV. What is the Tax Write Off for EV Chargers.

After expiring at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back. Up to 7500 Back for Driving an EV Get a federal tax credit of up to 7500 for purchasing an all-electric or plug-in hybrid vehicle. 2021 the federal government doled out 931 billion in Covid.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. For residential installations the IRS caps the tax credit at 1000. Some state agencies also offer tax rebates.

Analysts there credit changes in the electric vehicle tax credit passed in. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. Then it speeds up.

The credit varies depending on the vehicle make and battery. The federal tax credit for electric vehicle chargers originally expired on December 31 2021. Technically referred to as the Alternative Fuel.

It applies to installs dating back to January 1 2017 and has. The federal tax credit for electric vehicle chargers originally expired on December 31 2021. However the Inflation Reduction.

The tax credit now expires on December 31 2021. For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. The Inflation Reduction Act signed into law in August revived a tax credit for electric vehicle charging stations and EV charging equipment that had expired at the end of.

Qualifying EVs purchased before August 17 2022 are eligible for a tax credit that is available for the purchase of a new qualified EV that draws propulsion using a traction. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended through 12312032. The credit ranges from 2500 to 7500.

For example the New York State Department of Taxation and Finance offers an income tax credit of 50 of the cost of EV. The tax credit now expires on December 31 2021. Fill gaps in EV charging network is on its way.

This tax credit covers 30 up to 1000 per unit of the cost for. Unlike some other tax. How much is the electric vehicle tax credit worth in 2021.

The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. 14 hours agoYou may also be eligible to claim the refundable child tax credit that was approved for 2021.

Senators Introduce Bipartisan Bill To Expand Electric Vehicle Charging Tax Credit The Hill

Biden Endorses Electric Vehicle Tax Credit Transportation Today

Does The Kia Niro Ev Qualify For Tax Credit Electric Vehicle

Limited Time Only The Federal Ev Charging Tax Credit Semaconnect

Best Federal Tax Credits Rebates On Ev Charging Stations

Ev Tax Credit How Electric Car Owners Could Reap Benefits Of Inflation Reduction Act Gobankingrates

How To Claim An Electric Vehicle Tax Credit Enel X

5 Things To Know About The Updated Ev Charging Tax Credit Cleantechnica

Car Company Ceos Push To Lift Electric Vehicle Tax Credit Limit The Hill

All About Tax Credits For Installing Electric Vehicle Charging Stations Ev Connect

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Electric Vehicle Tax Credit All You Need To Know Hawthorne Auto Square

Ev Charger Federal Tax Credit Is Back Kiplinger

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Ev Charging Station Tax Credits Are Back Inflation Reduction Act Extension Of The Section 30c Tax Credit Blogs Renewable Energy Outlook Foley Lardner Llp

Ev Purchase Incentives Need To Shift To Point Of Sale Rebates